Conventional financiers also offer a. By Apnizan Abdullah - November 30 2019 221am.

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Malaysia Hub since its establishment has partnered with Malaysian counterparts in cementing the countrys global leadership in Islamic finance.

. As of end-2018 Malaysia continued to be the main driver for the sukuk Islamic bond market with 51 of the US396 bil of total global outstanding sukuk while. There are more than 265 Islamic. Of the main Islamic finance principles before discussing some of the chal-lenges faced by Islamic finance and suggesting potential solutions.

The industrys assets reached 2 trillion at year-end 2016. Since its inception over 30 years ago Islamic finance has become more vibrant with a diverse set of industry players. Integrating waqf crowdfunding into the blockchain.

There were 505 Islamic banks in 2018 including 207 Islamic Banking windows. Pure-play Islamic Banks and financial institutions manage over 250 billion of assets and a further 200- 300 billion is managed by the Islamic windows and subsidiaries of international banks. A 2016 BNM Islamic Finance Development Report highlighted that tawarruq is the most significant contributor to the financing portfolios of Islamic banking in Malaysia standing at 224 a drastic increase of more than 100 in just two years 2014-2016.

A modern approach for creating a waqf market 7780. This has been further hampered by a lack of trust among different faith communities where Muslims were historically charged higher interest rates by non-Muslim financiers Kuran and Rubin 2018. The purpose of this study is to analyze the impact of financial on the performance of Islamic Banks in Malaysia.

Total Islamic banking assets now make up 314 of total assets of the Malaysian banking system as at 2018 an increase from 2017s 30 according to preliminary data recorded in the Financial Stability and Payment Systems FSPS Report 2018 published by Bank Negara Malaysia BNM. Islamic Finance and Modern Economy The Global Islamic Finance 16. It has tremendous potential to grow further in future.

Total Islamic banking assets stood at RM91671 billion. From a historical perspective Islamic economic institutions have not been conducive to capital accumulation in Muslim societies Kuran 2004 2011. Capital Markets of the Muslim world.

A Global View 17. For expository purposes we have adopted a two-pronged approach in consid-ering these challenges through a discussion of key banking issues and then some capital market issues. Currently in Malaysia the Islamic Banks are exercising the most famous form of house financing bba home financing.

The Islamic Finance Development Report 2018 shows that the global Islamic finance industry grew year-on-year by of 11 to US 24 trillion in assets in 2017 or by CAGR growth of 6 from 2012 based on figures reported for 56 countries mostly in the Middle East and South and Southeast Asia. Which is why there is a need for Islamic financial institutions to be adequately capitalized. First Abu Dhabi Bank launches new sustainable current account enabling corporate clients to contribute to sustainable development.

Islamic financial institutions are lagging far behind the level necessary to enable them to thrive and compete effectively in a freely competitive global environment. Historically Malaysia has been a leader in developing innovative savings credit and investment instruments that are Sharia-compliant for low. However there are a.

Yet commercial banking remains the main contributor to the sectors growth. Financial services particularly banking are by nature long-haul business. Setia Fontaines prints unrated Islamic medium-term note worth RM8 million US182 million MALAYSIA.

Malaysia has recorded 173 growth of Islamic finances market between 2009 -2014 MIFC 2015a. Islamic banks Shariah-compliant investment and sukuk 16254. In Malaysia sadaqah seems to fall under the category of charities concerning Muslims provided in State List of the Ninth Schedule of the Malaysian Constitution which gives power to the states to regulate the matter.

Malaysia has maintained its position as the global leader in Islamic finance and the sector has matured. Kuwait Finance House Bank Saderat Iran Malayan Bank Berhad Maybank Malaysia Bank Maskan Iran. Thus Islamic finance can play a significant role in narrowing the gap of financial inclusion in Muslim countries.

Islamic finance industry will continue to expand this year but lose some momentum in 2018 according to SP Global Ratings forecast. These include tax incentives for debt over equity the tax treatment of sales and additional layers of transactions in some instruments. The inaugural issuance of the Worlds first green sukuk in Malaysia has expanded the narrative for the synergy between Islamic finance which values socially responsible investment and the global trends of.

The Paradox Within 7079. This study covers most of Islamic banking institutions in Malaysia which operated during period of 2008 to 2014. Maqasid al-Shariah and the legality of Islamic financial contracts 17304.

Time for Malaysia to lead Islamic social finance endeavours. Bba has started implementing. Islamic finance raises a number of taxation issues.

The Islamic banking and financial services industry showed a rapid growth during the last 10 years having accomplished a milestone reaching a value of more than 2 trillion by 2015. There are more than 15 billion Muslims all over the world and it is estimated that right around one of every four individuals on the planet rehearses Islam. Led by Islamic banking Malaysia s shariah-compliant financial sector is expected to expand at 20 per cent per year after recording a growth rate of 13 per cent over the last three years according to the Association of Islamic Banking Institutions in Malaysia The countrys 16 Islamic banks including five foreign ones hold more than USD135 billion in assets or 26 per.

Islamic funds and Islamic products are widely offered by financial institutions in Malaysia. Malaysia issues RM25 billion US5687 million Malaysian Islamic Treasury Bill UAE. In comparison in high-income OECD countries 52 percent of adults saved formally.

Islamic Finance and Modern Economy Development in the Islamic Finance industry The Islamic banking and finance market is growing at a rate of 15 to 20 per year. Islamic Finance and Modern Economy Sukuk Market. Issues in Islamic banking and finance.

One study of which modes of Islamic finance were used most frequently found PLS financing in leading Islamic banks had declined from. I-FIKR brings you daily news and updates on Islamic finance. Islamic banks at least in Saudi Arabia and Egypt have departed from using profit-loss-sharing techniques as a core principle of Islamic banking according to a 2006 dissertation by Suliman Hamdan AlbalawiMalaysia has also seen a decline.

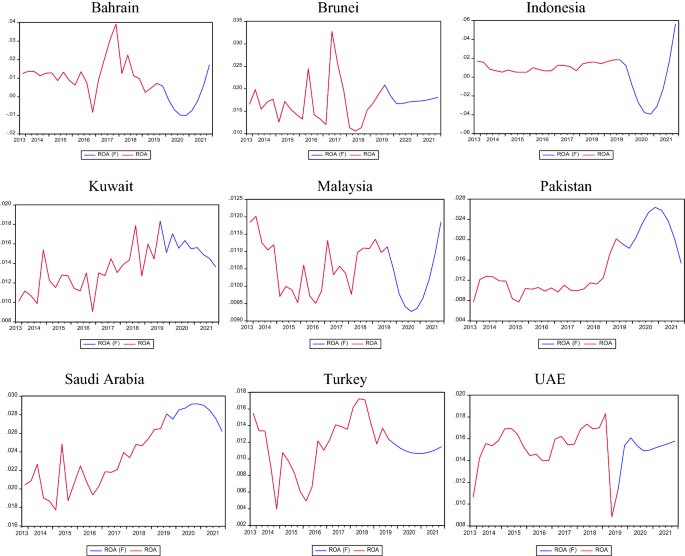

ACCORDING to the State of the Islamic Economy. By using a panel data series the data for 15 Islamic banks are taken from the Bank Scope database. Iran Saudi Arabia and Malaysia remain the largest Islamic finance.

The Growing Global Appeal Of Islamic Finance

Islamic Finance In Africa Opportunities And Challenges White Case Llp

Connecting Malaysia S Islamic And Sustainable Finance To The World

Pin By Nani Sg On Other Inbox Screenshot

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Ethical Considerations In Qualitative Study Study Site Ethics Study

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Image Result For Best Resume Templates 2018 Malaysia Resume Template Word Best Resume Template Resume Template Professional

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Regulatory Policies In The Global Islamic Banking Sector In The Outbreak Of Covid 19 Pandemic Springerlink

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

Pdf The Intention To Use Islamic Banking An Exploratory Study To Measure Islamic Financial Literacy

Regulatory Policies In The Global Islamic Banking Sector In The Outbreak Of Covid 19 Pandemic Springerlink

Pdf Why Non Muslims Subscribe To Islamic Banking

Pdf The Impact Of Ijarah Lease Financing On Malaysian Islamic Bank Performance

- sewa kereta in english

- nama bayi di dalam alquran

- cara buat surat cuti sekolah sakit

- maksud nama adriana batrisya

- beras pulut hitam kuih

- poster jualan makanan

- all in mobile pasir putih

- coffee consumption in malaysia

- sakit kepala sebelah kanan belakang

- apa itu aircond kereta

- contoh surat rasmi memohon sumbangan dana

- demam denggi zon merah

- darling 2 full movie

- nasi putih ikan sos kaphau

- perkataan pinjaman bahasa inggeris

- senarai harga baiki kereta 2018

- nasi lemak peel road

- penyakit kulit putih di leher

- nama kek lapis sarawak paling sedap

- minyak daun bidara malaysia